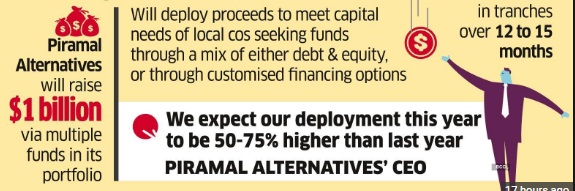

Piramal Alternatives plans to raise $1 billion through multiple funds in its portfolio from a group of global investors, seeking to tap into the increasing local appetite for cash as interest in IPOs begins to dry up.

Multiple people familiar with the fundraising told ET that the proceeds will be deployed to meet the capital needs of local companies seeking funds through a mix of either debt and equity, or through customised financing options.

Piramal is in talks with a group of global investors, such as Canadian CDPQ and CPPIB, and the Netherlands-based APG Asset Management, sources said.

“We continue to partner with sophisticated, blue-chip, global institutional investors, who are seeking predictable, long-term returns from the Indian markets,” Kalpesh Kikani, CEO at Piramal Alternatives, said in response to ET’s queries.Even a supranational institution is said to be in talks with the Piramal Alternatives.

Kikani declined to disclose the names of the global investors the firm is in talks with. CPPIB and APG also declined to comment on the matter. CDPQ did not respond to ET’s query.

Global investors bring in all the long-term capital through subscription to Piramal Alternatives’ funds.

Launched about a year ago, Piramal Alternatives is an arm of

Piramal Enterprises

NSE 3.95 %. It runs multiple funds to support the capital needs of mid- to large-size Indian companies that need bespoke capital solutions unavailable at traditional financing sources.

“Piramal Alternatives is the investment manager where we raise funds with a 10+ year fund life to enable our companies to have a long horizon to execute their growth plans,” said Kikani.

Piramal Alternatives invests across three strategies: performing credit, turnaround capital and hybrid funding.

In its first year of operation, Piramal Alternatives has deployed over ?2,000 crore across eight deals using a variety of instruments such as bonds, equities, loans and convertible instruments.

Even after covering for exchange rate risks, Piramal Alternatives has generated mid-to-late teen dollar returns for their global investors in FY22, sources told ET.

“We expect our deployment this year to be 50-75% higher than last year,” the CEO said.

This fiscal year, many companies had to drop plans for IPOs in a sliding market. This has necessitated either debt fundraising or private equity engagements.

With interest rates rising both globally and in India and challenges mounting in closing private equity deals due to significant valuation disparity between investors and companies, fundraising has become tougher.

Source-https://economictimes.indiatimes.com/industry/banking/finance/piramal-alternatives-plans-to-raise-1-billion/articleshow/92213452.cms