Digital payments company PhonePe is scripting a detailed plan to fuel its ecommerce strategy as it integrates with the government’s Open Network for Digital Commerce (ONDC) project.

The fintech player’s online commerce ambitions aren’t new.

It made attempts previously with offerings such as Switch, loosely based on a super app concept, and Stores, which was aimed at facilitating hyper-local discovery of merchants.

Switch, which hosted several services across food-delivery, grocery and pharmacy apps, saw traction for travel booking while other segments had limited success.

Subscribe to ETPrimeWhile PhonePe Switch and Stores still exist, the Walmart-owned company will launch a separate consumer buyers’ app by the end of the month that will be a part of the ONDC network, India’s infrastructure bid to break the dominance of ecommerce giants Amazon and Walmart-owned Flipkart in the country.

PhonePe’s buyer app will be a consumer-facing platform that will allow shoppers to choose various products from sellers.

Its name is as yet under wraps.

PhonePe is a leading payments player in the Unified Payments Interface (UPI) digital railroad and will make a splash into ecommerce with the hyper competitive grocery category.

Launching in its home ground Bengaluru, the battleground for pilot projects, PhonePe will slug it out against quick commerce players including Zepto, Swiggy Instamart and others.

The company has set up an independent team and will be adopting an intra-city model to solve hyperlocal commerce, founder and chief executive Sameer Nigam told ET in an interview.

It has earmarked up to $15 million for its ONDC entry, and the capital will be deployed over the next 18 months, Nigam said.

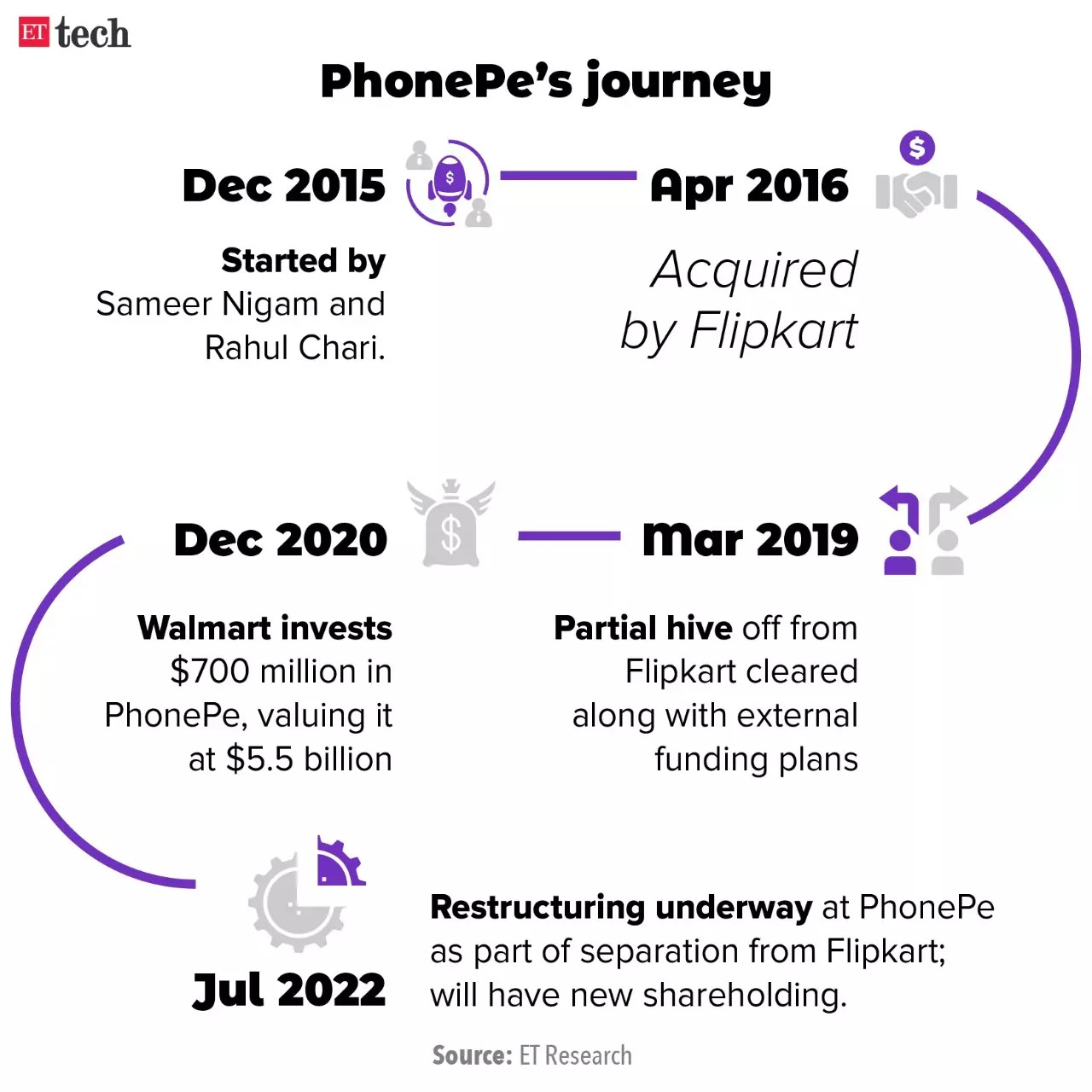

PhonePe is looking to break away from its Flipkart roots after being acquired in 2016 as an idea-stage startup.

Flipkart cofounder Binny Bansal, who is on the PhonePe board, was instrumental in the acquisition six years ago.

The fintech firm is in the middle of domiciling its holding structure in India, giving up on its Singapore-registered entity.

If its commerce plans take off, PhonePe will compete directly in the hyperlocal commerce segment with Flipkart Quick, which delivers grocery and other items within 45-60 minutes.

Long-term bet

For Nigam, ecommerce is a long-term wager.

“It (ecommerce) is somewhere between moonshot– because of ONDC – and a very large market to tap into… The opportunity is larger than payments but it is much riskier… because nowhere in the world any government or industry has aggregated so many aspects of fulfilment– logistics, inventory management, seller and buyer platforms among others,” he said.

ONDC is a key project of the central government.

“They (PhonePe) did go slow for some time on the seller side integration as the focus is to get the beta app up and running and start iterating for consumers,” one of the people aware of ONDC integrations said on condition of anonymity.

Nigam said its first beta launch will take place by the end of this month.

“Commerce will be more complex than UPI since actual physical service providers will have to come together for this use-case,” he added.

Grocery was an obvious choice to start with as multiple sellers had already begun digitising, he said, especially since the category has the largest share of ecommerce.

“Vision-wise I would rather service a city with all categories than expanding into cities. Our job is to activate sellers to fulfil orders digitally in their local ecosystem. So, we are not focused on pan-India,” Nigam told ET.

He added that the rationale behind launching a separate app was to differentiate the user experience for making payments and buying financial services from that of ecommerce.

It also did not want to slow down newer app releases and updates for commerce by keeping the option in the main PhonePe app.

According to the company, PhonePe’s existing app will not be utilised for directing users to the new apps and there will be no cross-selling between the two apps.

Revenue pressure

While PhonePe amps up its e-commerce play, it is fighting a battle like others in the industry to bring the merchant discount rate (MDR) back for UPI payments, its biggest business vertical.

The company has also applied for licenses for stock broking, account aggregator and pushing for financial services as a revenue driver in the next two fiscal years.

“As payments turn into a zero-sum game in terms of revenues, players like PhonePe have to show strong monetisation streams. Just financial services distribution will also leave thin margins on the table… It will have to get into manufacturing and the licence acquisition strategy is part of the plan,” said an entrepreneur running a payments firm.

Nigam said PhonePe is betting big on financial services in the future.

“That’s just a natural adjacency for the business we’re in. Shopping and IndusOS are moonshot businesses for us. Getting into ONDC would have happened with or without focus on monetisation… If ONDC didn’t happen, it is unlikely we would have gotten into commerce,” Nigam said, adding it would have then added only some features for merchants to connect to users.

The most vague aspect about ONDC currently is the economics,” said Nigam, when asked about monetisation from the ecommerce vertical.

While the government’s idea is to scale the network, its chief executive T Koshy has said previously that there will be monetisation for platforms but it’ll come gradually.

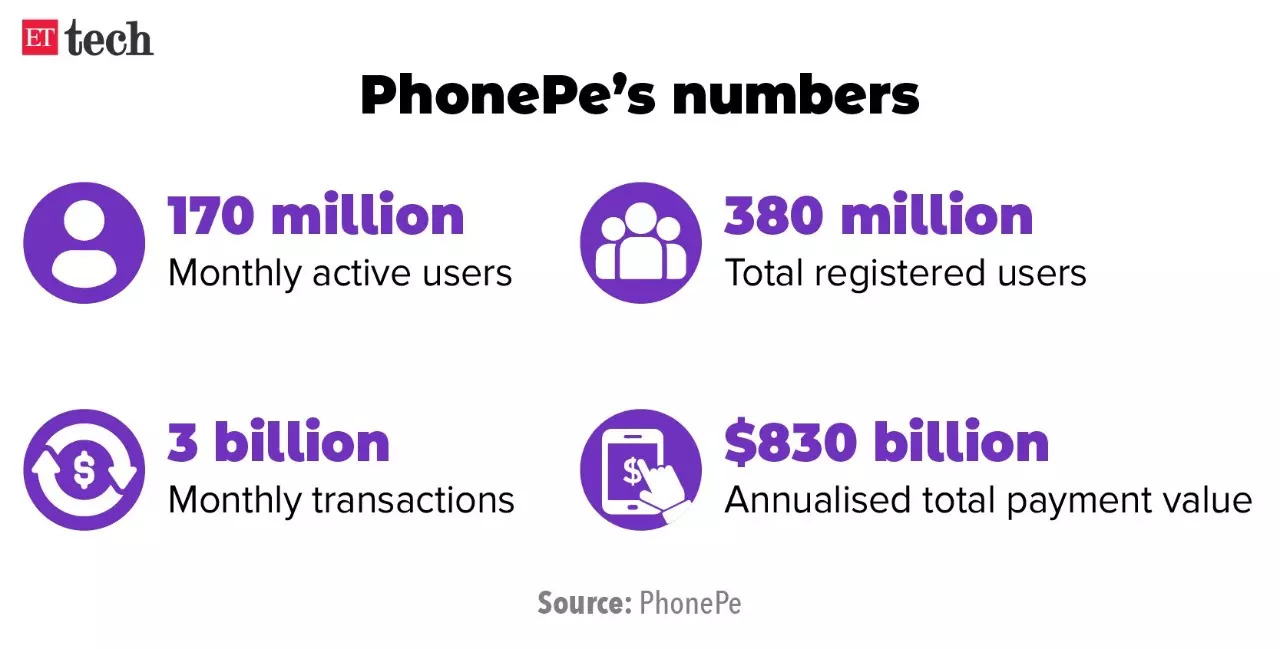

PhonePe, according to sources, is currently on an annualised revenue run-rate of $300-350 million. The company is valued at $5.5 billion but Nigam has held talks with investors to raise new capital indicating a valuation of at least $12 billion, ET reported on July 27.

The ecommerce foray could play a role in increasing revenue streams and enabling it to achieve a higher valuation over a period of time given the broader market opportunity. The retail market is said to be $600 billion in size and ecommerce still has a 5–7% penetration in the country, according to multiple industry reports.

“They (PhonePe) have sought multiple licences recently and ecommerce is the first non-financial services bet they are taking seriously. It remains to be seen how the fintech bets play out but they don’t want to let go of the commerce opportunity,” one of the people mentioned above said.

Nigam told ET that they need more than three years to assess if the ecommerce project has taken off.

PhonePe is also evaluating partners and looking to onboard sellers and logistics platforms, while taking care of the shopping experience for users.

“If you ask me what I’m most excited about it is the logistics… ONDC is actually logistics-as-a-service, not commerce-as-a-service. What ONDC will solve for the long haul is the stocking information becoming almost real-time,” added Nigam.

He added that PhonePe has no immediate plan to enter the logistics and supply chain business by itself. Flipkart’s logistics arm Ekart is in the process of integrating on the ONDC network.

Stores and learnings

PhonePe’s ‘Stores’ offering was launched in 2019. Through the tab, PhonePe was looking to make discoverability of newer kiranas (neighbourhood stores) easier, through a heatmap.

It later added features like chat and deals to push users to shop through their neighborhood kiranas, capitalising on the Covid-19 induced lockdown, while the experience was still offline.

In 2020, during the peak months of Covid-19, PhonePe was in talks with the likes of hyperlocal service providers including Swiggy and Dunzo for potential tie ups to even make online deliveries at a consumer’s doorstep. However, that never materialised. Nigam said that while the Stores features worked as a payment growth hack, the platform was not able to cater to the needs of customers and merchants entirely.

“It was a slow bake… Those who wanted to make payments also wanted to see what they could order and checkout. We fell short of that and couldn’t get into checkouts since we did not have an answer to logistics and inventory information. This is where the inspiration to join ONDC came,” adds Nigam. He also added that overtime, based on the success of the ONDC platform, the company could remove the Stores tab from the main PhonePe platform.

Source :https://economictimes.indiatimes.com/tech/technology/how-phonepe-is-sharpening-its-e-commerce-ambitions-as-it-breaks-away-from-flipkart/articleshow/93601216.cms