Budget 2023: Personal Income tax is an important part of the budget. In 2020, the government proposed a new tax regime for taxpayers. The new income tax regime is optional.

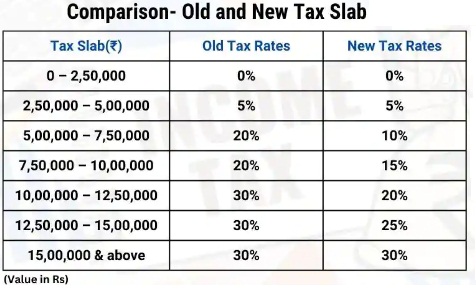

In the new tax regime, the government added more tax slabs and lower tax rates. This was long demanded by most taxpayers, but it came with the catch of removal of all the deductions and exemptions that were available under the old tax regime.

In the new regime, there are more tax slabs, accompanied by lowering of rates in the Rs 15 lakh range. Additionally, all the exemptions and deductions that were being used by taxpayers in the old regime are not available in the new regime.

Old Tax Regime

In the old tax regime, there are many ways to reduce tax liability. Exemptions like House Rent Allowance (HRA) and Leave Travel Allowance (LTA), deductions allow taxpayers to lower their tax amount by investing, saving or spending on specific items.

The biggest section for deduction is Section 80C through which taxpayers can bring down their taxable income by Rs 1.5 lakh. Apart from this, there are several other sections that let you take tax deductions on things ranging from interest on your loans (home and education) to premiums you pay for health insurance.

Here is a comparison between the old and new tax slabs

Exemptions & Deductions

What is Tax Deduction?

Tax deduction refers to claims made to reduce a taxpayer’s taxable income, arising from various investments and expenses incurred by a taxpayer. Thus, income tax deduction reduces overall tax liability. It is a kind of tax benefit which helps one save tax.

What is Tax Exemption?

A tax exemption is the right to have some or all of one’s income exempt from a country’s taxation. The majority of taxpayers are eligible for a number of exemptions that can be used to lower their taxable income, while some people and organisations are fully free from paying taxes.

With the new tax regime, several exemptions and deductions were removed. Below is a comprehensive list if you fall under the category of a salaried individual or business or professional.

– Salaried individuals could claim a standard deduction of Rs 50,000.

– Leave Travel Allowance

– House rent allowance depending upon salary structure and rent paid

– Professional tax paid by a maximum of Rs. 2,500/-

– Deductions available under Section 80TTA and 80TTB that is interest from Savings Account/Deposits

– Tax deduction on entertainment allowance and deduction on professional tax For government employees

– The interest amount payable on home loan for a self-occupied or any vacant property u/s 24 maximum deductions of Rs. 2 lakhs

– Deduction of Rs 15,000 allowed from family pension under clause (ii) (a) Section 57

– Special Allowances that are provided under Section 10(14) except:

– Transport allowance granted to a disabled employee

– Conveyance allowance

– Any allowances granted for meeting the cost of travel on tour or transfer of an employee

– Daily allowance

– Perquisites

– Business owners and professionals will lose the exemption to Special Economic Zones under Section 10AA.

– Deductions under Section 32AD, 33AB, 33ABA, 35(1)(ii),35(1)(ii( (a), 35(1)(iii), 35(2AA), 35AD and 35CCC of the Income Tax Act.

– Options of additional depreciation under Section 32(ii) (a) of the Income Tax Act

– The option to carry forward or unabsorbed depreciation of earlier years

– Tax-saving investment deductions under Income Tax Act , Chapter VI-A 80C, 80D, 80E, 80CCC, 80CCD, 80D, 80DD, 80DDB, 80EE, 80EEA, 80EEB, 80G, 80GG, 80GGA, 80GGC, 80IA, 80-IAB, 80-IAC, 80-IB, 80-IBA, etc. These tax-saving investment options include ELSS, NPS, PPF tax relief on medical insurance premium, FDR, dependents who are differently-abled, expenses for specific medical treatments, interest on education loan and many more.

Source: https://www.zeebiz.com/personal-finance/income-tax/news-old-income-tax-regime-vs-new-how-are-both-different-210249