The development comes ahead of the Noida-based company’s planned initial public offering (IPO) slated for November.

Paytm recently granted new employee stock ownership plans (Esops) to 166 former and current employees, which were then converted into shares of the company, latest regulatory filings with the Registrar of Companies showed.

The development comes ahead of the Noida-based company’s planned initial public offering (IPO) slated for November.

Cumulatively, over a million Esops were granted to mostly senior staff members.

The Esops were granted at a price Rs 9 each.

Based on Paytm’s last valuation of $16 billion (about Rs 1.2 lakh crore), these converted Esops are worth over Rs 182 crore.

“Paytm shares were last valued at Rs 18,000 apiece. Now after the 1:10 stock split, it would be Rs 1,800 per share,” a person aware of the matter said.

This means for each Esop that was granted, the employee has got 10 shares upon conversion.

Among the staff who have exercised the conversion option include Paytm’s former president Amit Nayyar, the documents showed.

ET reported on August 16 that around 300 employees were looking to convert their Esop grants to shares before its much awaited $2.2 billion IPO.

At the time of converting stock options to shares, employees have to pay a tax, which would be applied on the difference between the current share price and the price at which the Paytm shares have been granted.

Paytm Esop conversion plan comes close on the heels of food delivery app Zomato‘s stellar listing in July, which spawned about 18 dollar-millionaires among its senior leadership.

Earlier this month, Paytm had told its shareholders that it was planning to more than double its Esop pool before its extraordinary general meeting (EGM) scheduled for September 2.

Esops have always been used as a tool to attract and retain talent in new-age companies.

Over the last 12-18 months, demand for Esops has jumped along with the valuations of companies, due to the record amounts being pumped into the startup economy.

Top-tier startups like PhonePe, Udaan, Razorpay, Cred, Acko, Zerodha and Ola have granted Esops to their employees.

The idea is that these shares can be sold at a higher value at the time of an IPO or share buyback by the company.

ET reported last month that a host of startups had cumulatively done share buybacks worth almost $546 million in the last one year.

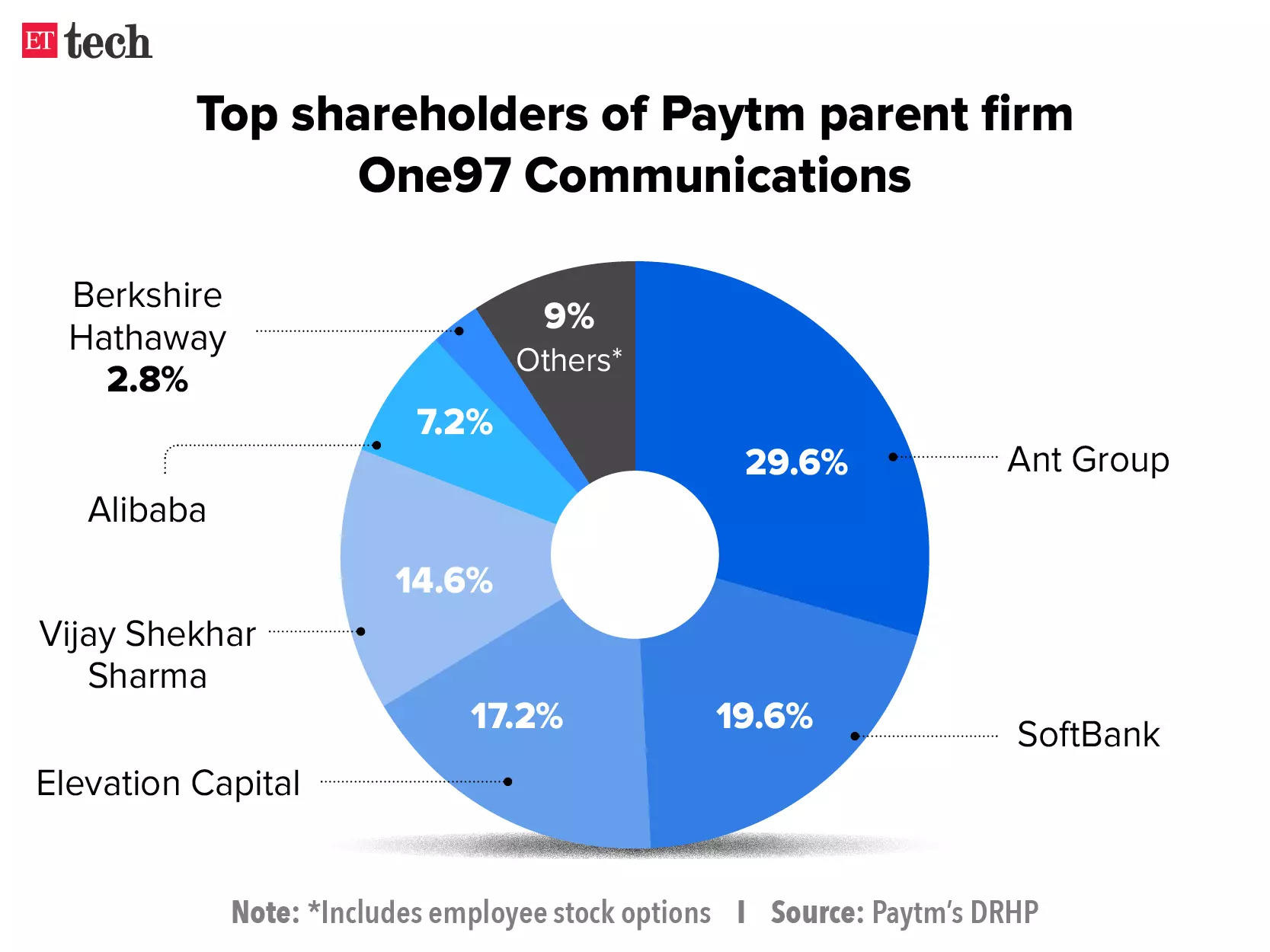

In July, Paytm filed a draft red herring prospectus (DRHP) with capital markets regulator, the Securities and Exchange Board of India (Sebi), to raise Rs 16,600 crore ($2.2 billion) through a public issuance, in what will be one of the biggest Indian IPOs in at least a decade.

The stock offering will comprise a fresh issue worth Rs 8,300 crore ($1.1 billion) and a secondary issue or an offer for sale (OFS) of the same size, Paytm told Sebi.

The company may also consider a pre-IPO funding round of up to Rs 2,000 crore.

If that happens, the size of the fresh issue will be adjusted accordingly, according to its DRHP.

Source : https://retail.economictimes.indiatimes.com/news/e-commerce/e-tailing/paytm-staff-ex-employees-convert-esops-to-shares-worth-rs-182-crore/85613424